The hotel industry has always been fairly generous with its cancellation policies. Until recently, the majority of hotels would allow guests to cancel their reservation without penalty until 6 p.m. on day of arrival. Customers appreciated it, but last-minute cancellations were always a burden on the hotel, especially on the person in charge of filling those lost rooms.

One of the few options for hoteliers to fill late-vacated rooms is to sell the inventory on discounted channels and recover only a portion of the initial reservation. Today, with the availability of more comprehensive data sources, including cancellation information, there is increased scrutiny over just how much cancellations are costing hotel owners.

Earlier this week during an earnings call with analysts, John Arabia, CEO of Sunstone Hotel Investors, a REIT that owns 28 hotels, blamed the hotel industry’s inability to grow Average Daily Rate partially on a “self-inflicted wound,” inferring the industry is mismanaging cancellation policies. He said hotels are giving travelers “free options” by allowing them to book a room, wait to see if rates drop all the way up until day of arrival, and then cancel and rebook.

[bctt tweet="To protect revenue, #hotels mull changes to generous #cancellation policies #revenuestrategy"]

“Simply put, the free optionality provided to hotel consumers is weighing on our profits and needs to be changed,” Arabia said. “Our sister industries, including airlines, cruise lines and casinos, have done a far better job in charging for the product at the time the reservation is made or charging material cancellation fees for the option to change plans.”

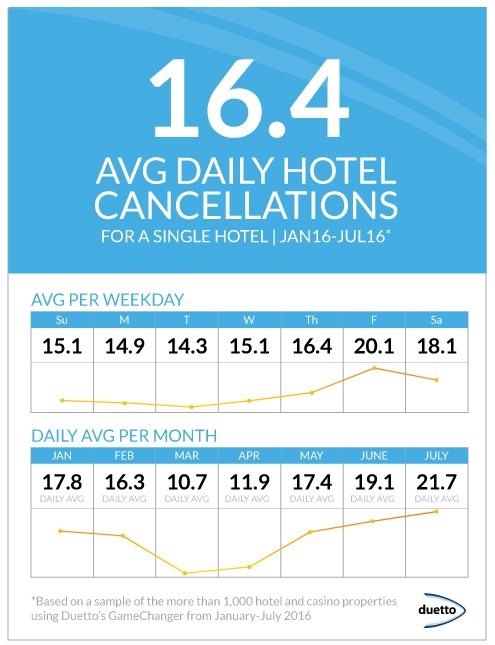

A sample of the more than 1,000 hotel and casino properties using Duetto’s Revenue Strategy solution, GameChanger, recorded an average of about 16 canceled rooms per day between January and July.

By day of week, Tuesday shows the least amount of cancellations at an average of 14.3 per hotel, and Friday the most with an average of 20.1 canceled rooms per hotel.

In May, hotels in the sample saw an average of 17.4 cancellations per nig ht. In June, that number rose 9.8% to 19.1 cancellations. And in July, the average number of canceled rooms per hotel per night jumped 13.6% to 21.7.

ht. In June, that number rose 9.8% to 19.1 cancellations. And in July, the average number of canceled rooms per hotel per night jumped 13.6% to 21.7.

Changing cancellation conditions

To hotel operators’ credit, changes to strengthen cancellation policies are already underway.

In 2015, some major hotel companies began to extend the minimum notice of cancellation for guests to avoid fees. Some went from 6 p.m. on day of arrival to 24 hours or as much as 14 days notice required.

Prior to that, hotel companies such as Marriott International, Hilton Worldwide and InterContinental Hotels Group, among others, adopted a strategy to offer nonrefundable room rates at a lower price point.

According to a recent Travel Weekly report, hoteliers have since found that offering the discounted, nonrefundable rates to guests that book earlier in the booking window is moving the needle much more than increased cancellation fees. The article cites the New York Marriott Marquis, which was offering prepaid, nonrefundable rooms for late-September weekend dates at about a 15% discount when the story published.

One wrinkle in hotels requiring travelers to pay in advance for a nonrefundable rate is that it takes away an advantage suppliers had over OTAs, which are not often able to sell hotel rooms with favorable cancellation policies attached.

The technology game

As Arabia noted, new technologies are giving power to consumers to cancel and rebook at lower costs easier than they ever could before. With the rising popularity of last-minute OTAs and increased consumer transparency over hotel inventory management, more guests can game the system.

This cancel-and-rebook trend is illustrated by the fact that an increase in industry-wide cancellations has not led to more revenue from cancellations for hotels. As a percentage of operating income, attrition and cancellation fees fell each year from 6.8% in 2009 to 2.1% in 2014, according to CBRE.

Group blocks are especially vulnerable. After a large convention ends, attendees will often immediately reserve rooms at several hotels in advance of the following year’s event, knowing rooms will go quickly. Then, once event details become available and the locations of networking events surface, attendees will choose the most convenient hotel and cancel the remaining reservations. Sometimes they’ll wait until the last minute.

On top of that, a handful of booking sites like TripAdvisor’s Tingo have emerged, selling hotel inventory to consumers and promising to continuously monitor those reservations for price drops through date of arrival. If the rate drops at any time, the site will automatically cancel and rebook the reservation at the lower rate.

But hoteliers can respond by capitalizing on advances in technology to counter-punch with their own data-driven strategies.

Duetto, for instance, allows hotels to assign cancellation policy terms individually to each rate code they offer. And the predictive analytics platform uses multiple data sources to help hoteliers forecast cancellations by segment, giving them insight into pricing and potential overbooking strategies. Alerts will notify hotels when they’re seeing an unusually high number of cancellations.

Because of new insights like these into consumer behavior, hotels are able to adjust and get more creative with their cancellation policies. Advances in technology are allowing them to test and iterate.

While consumers might scoff at nonrefundable rates, higher cancellation fees or earlier deadlines for cancelling reservations, hotel companies will continue to be aggressive in wooing them to book direct. Look for more personalized loyalty pricing or perks like free WiFi and free breakfast to replace those lenient cancellation policies.